Cut your Merchant Cash Advance payments by up to 75%. Performance based Debt Settlement. Pay ZERO success fees unless we Settle your Debt!

… without High-Pressure Sales Tactics or Hidden Fees!

Eliminate Up to 75% of Your MCA Debt

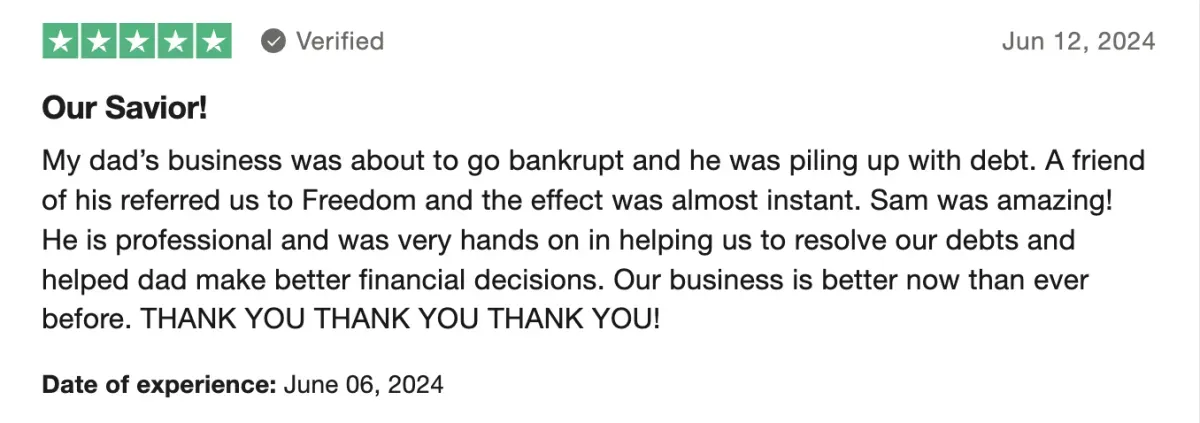

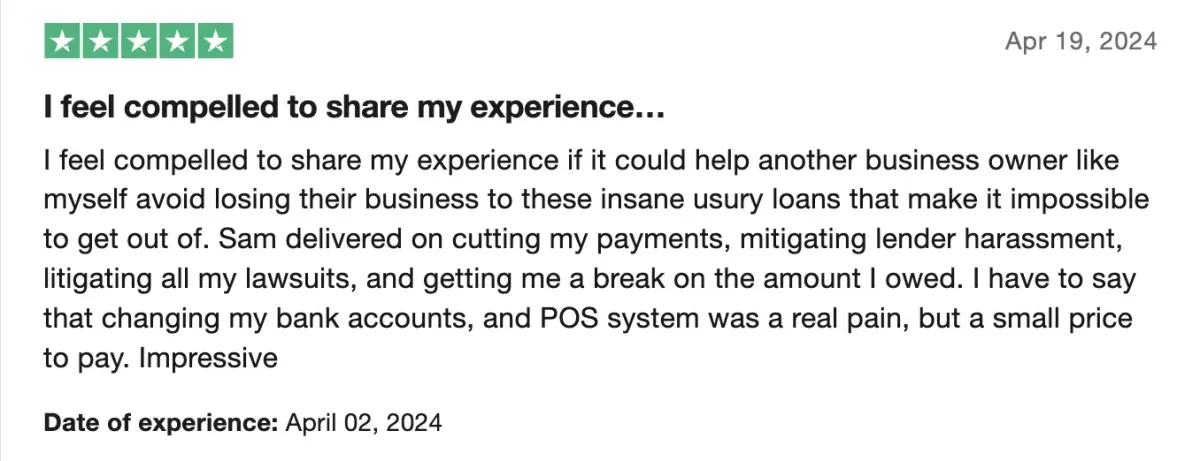

Read How We Helped Other Business Owners Like You

Eliminate Up to 75% of Your MCA Debt Instantly

Many business owners with MCA's are often overwhelmed by the constant pressure of daily and weekly payments draining their cash flow. By working with us, you can eliminate up to 75% of your MCA payments overnight.

We engage your creditors immediately, unlike our competitors who wait months, ensuring quick debt reduction and relief from financial stress.

Eliminate up to 75% Of Your Merchant Cash Advance Debt Overnight!

Boost Your Cash Flow by up to 75%

Struggling to keep up with daily and weekly loan payments can cripple your business operations. By allowing us to negotiate and restructure your loan terms, you can see an up to 75% increase in your cash flow right from the start.

This surge in cash flow lets you redirect precious resources back into your business, enabling growth and stability while we manage your debts and lenders.

Increase Your Cash Flow by 75% Instantly and Focus on Growing Your Business

Experience Relief from Aggressive Lenders

The high-pressure tactics and threats from MCA lenders can cause significant stress and distraction. With our services, you no longer have to deal with these nuisances.

We take charge of negotiations and eliminate harassment from lenders, legal threats, and collections, allowing you to focus on running and growing your business without interruptions.

Save 20-30% Off Your Total Loan Balance in Just 30 Days

OUR PROCESS

Our 4-Step Debt Relief Process

Your journey to financial relief begins with a personalized consultation. We'll take the time to understand your unique business challenges, uncover the extent of your MCA debt, and discuss your goals for achieving financial freedom. This initial conversation is critical as it allows us to tailor our approach to best serve your specific needs.

Next, we conduct a thorough financial assessment. Our team will review your business's financial documents, current debts, contracts, and repayment schedules. We dive deep into your financial situation to identify the most effective strategies to tackle your debt. This step includes analyzing cash flow, projections, and any existing agreements with creditors.

With a clear understanding of your financial landscape, our experts begin direct negotiations with your MCA lenders. Unlike competitors, we engage lenders immediately, leveraging our negotiation expertise and bulk settlement capabilities to achieve better terms and reduce your debt. Our unique fee structure ensures we have the resources to engage the lenders from day one, providing swift relief from high daily or weekly payments, lender pressure and legal threats.

Once negotiations are successful, we implement the new repayment terms and monitor your progress. Our team provides ongoing support, ensuring your business remains on track and free from the manipulative tactics or harassment of MCA lenders and their collections agencies. We also offer an affordable legal plan if needed, but our priority is always immediate action and sustainable debt relief. 99% of our clients do not need to enroll in the legal plan due to our immediate engagement with their lenders

Reviews

What People Say About Us

They deliver the results they promise and have the most helpful staff. I have nothing to say but nice words and I definitely recommend their service to people like me who find themselves in the nightmare world of merchant cash advance crooks.

Candice P.

If I could give more than just 5 stars, I would! They deserve the best ratings and the best praises, for the amazing efforts and results. They managed to negotiate with my creditors that were sucking me dry. FDR managed to get me a great settlement for a seven figure debt and I’m forever thankful for their service.

Xenia S.

I was planning to just close my business and file bankruptcy. I was tied to MCA debt that continued haunting me and Sam and Andrew managed to negotiate a settlement that I could afford and finally get my creditors off my back and out of my bank accounts!

Ruth H.

I contacted 3 companies that offer the same service and only Freedom Debt Resolution gave me the service I needed and the results I was after. They were very hands-on with their work, constantly updating and very responsive with the communication.

Lynn T

If I could give more than just 5 stars, I would! They deserve the best ratings and the best praises, for the amazing efforts and results. They managed to negotiate with my creditors that were sucking me dry. FDR managed to get me a great settlement for a seven figure debt and I’m forever thankful for their service.

Xenia S.

I was planning to just close my business and file bankruptcy. I was tied to MCA debt that continued haunting me and Sam and Andrew managed to negotiate a settlement that I could afford and finally get my creditors off my back and out of my bank accounts!

Ruth H.

The Ultimate Business Debt Relief Solution

Regain Financial Control and

Boost Cash Flow Effortlessly

Legal Representation

Ensure your business interests are protected with our expert legal services.

Increase Monthly Cash Flow

Ensure your business interests are protected with our expert legal services.

Mitigate Creditor Harassment

Ensure your business interests are protected with our expert legal services.

Avoid Filing Chapter 11 Bankruptcy

Ensure your business interests are protected with our expert legal services.

Learn How We Can Settle Your Debts and Free Up Cash Flow Starting Today

Frequently Asked Questions

Here Are Some Of Our Most Common Questions

How do I know this will work for me?

If you're considering our services, it's likely you're searching for a reliable solution to manage your business debt. But where do you start?

First, you need to find someone with proven expertise.

Nothing is worse than working with a company that overpromises and underdelivers, especially when it comes to your financial health.

Most companies you look into will fall into two categories:

• Category 1 - Debt Counseling Services

These are typically "do-it-yourself" programs.

These services offer some guidance and education but often leave you to manage most of the process on your own. You'll have access to resources and perhaps some group calls, but the brunt of the work is on your shoulders and you still have to find and pay for expensive legal services.

• Category 2 - Debt Settlement Companies

This is the "done-for-you" model.

These companies offer to handle your debt settlement entirely. However, they often come with high fees, and their aggressive tactics can sometimes have long-term negative impacts on your credit.

So, how are we different?

We bridge the gap between these two models, bringing you the best of both worlds.

Here's our approach:

• Expertise & Transparency: We thoroughly explain our process, so you know exactly how we operate and what to expect.

• Hybrid Service Model: We'll create a tailored debt restructuring plan for you aimed ensuring there are always available funds to deal with your creditors and work closely with you to ensure it's executed perfectly.

• Comprehensive Support: From negotiating with lenders to consolidating debt and restructuring loan products, we're with you every step of the way. You get immediate relief and long-term strategies to ensure your financial stability.

Am I a good fit for you?

We specialize in aiding business owners who are struggling with Merchant Cash Advances (MCAs) and are in need of long-term financing solutions.

Our Ideal Clients:

• Business owners who have taken out at least one MCA.

• Companies with at least $40K in debt.

• Those finding it challenging to keep up with daily or weekly repayment schedules.

We work with businesses that not only need a breather from aggressive lenders but also wish to regain control over their finances to focus on growth.

Do you have proof that you will be successful in my industry?

Here's what you need to know:

• We've over Five Thousand clients across various industries, eliminating up to 80% of their debt and significantly improving cash flow.

• Our clients often record testimonials or consent to interviews showcasing their positive outcomes—proof that our methods work.

• Even if your specific industry isn't featured in our case studies, the fundamental principles of debt relief we employ are universally effective. The nature of business debt and the strategies to manage it remain consistent across industries.

Still unsure? Meet with our team—our experts know exactly who we can assist. We will not take on business we feel cannot benefit from our services.

How long does it take until I start seeing results?

Immediately, the impact is noticeable immediately—within up to a few days of starting the process.

Here's a general timeline:

• Initial relief from debt payments can begin within 24 hours.

• Substantial cash flow improvements are typically seen within a few days to a few weeks.

• Long-term restructuring and stabilization can take a few months.

Regardless, all our clients see significant improvements as their financial burdens are alleviated, enabling them to focus more on growing their business while we deal with handling their Creditors.